Financial Fit meets Dream School

Need-based aid, merit awards, and Ivy policies—decoded

.png)

1. Ivy League Aid in One Sentence

Ivies are need-blind for U.S. applicants, offer zero merit scholarships, and promise to cover 100 % of demonstrated need.

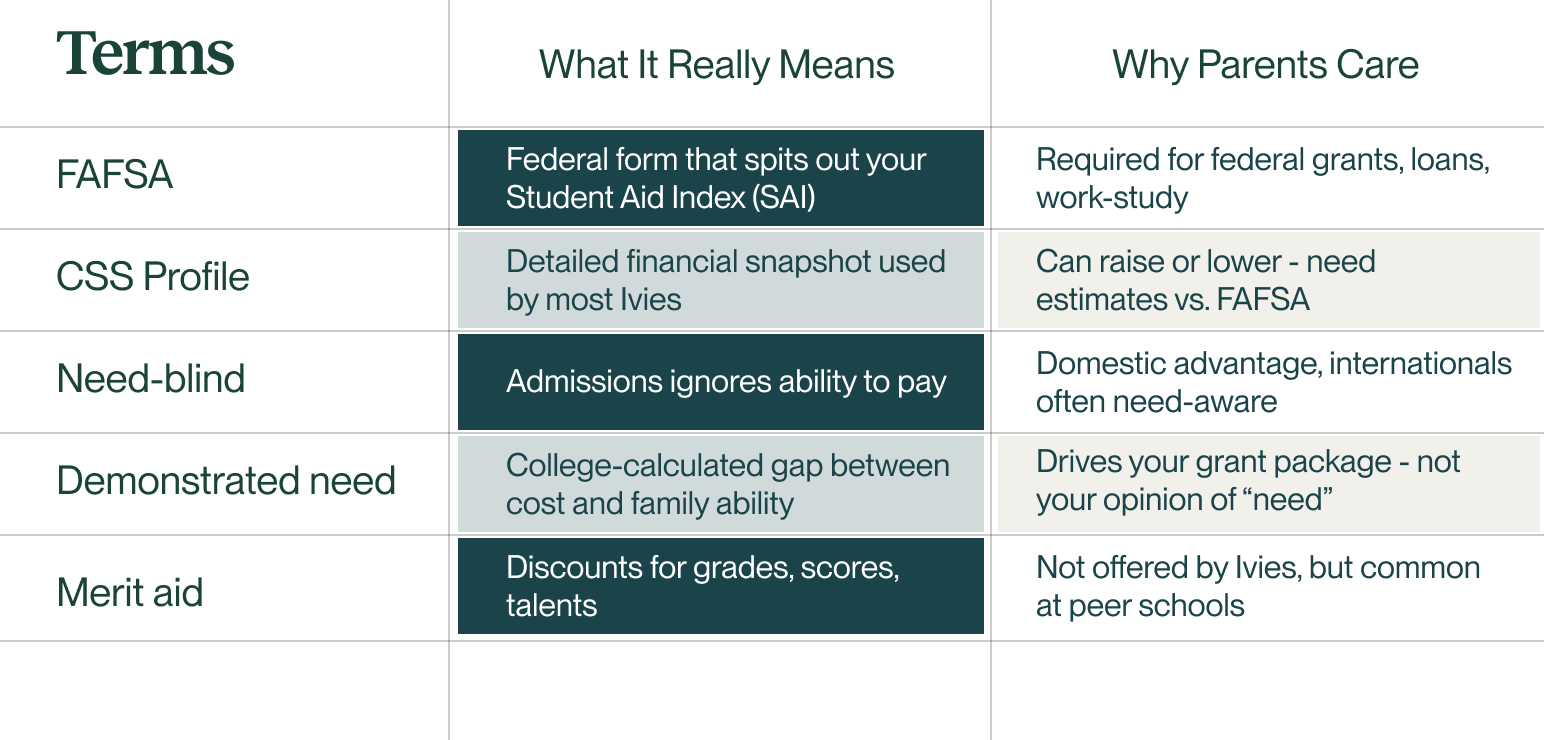

2. Key Terms, No Fluff

3. The Ivy League Funding Formula

Cost of Attendance – SAI (via FAFSA/CSS) = Demonstrated Need

Ivies commit to meet that number with grants, campus jobs, and capped loans (or loan-free at some schools).

4. Four Parent Moves to Maximize Aid

- Run Net Price Calculators (NPC)—one per Ivy on your list—before junior-year course selection.

- Shift Savings Strategy—3–4 years out, move student-held assets to parent accounts; FAFSA assesses them at 20 % vs. 5.6 %.

- Time One-Off Income—bonus or stock sale? Push it outside the “base year” (January 1 of sophomore spring to December 31 of junior fall).

- Stack Outside Scholarships Early—Ivies may reduce institutional grants dollar-for-dollar; aim to win funds for “unmet need” items (travel, books) before aid packages finalize.

5. Merit-Aid Work-around

Target “Ivy-adjacent” schools—Duke, Vanderbilt, USC, Northeastern, etc.—that do court high-achievers with $20 k–$50 k annual awards. Apply early, leverage offers as financial safety nets.

6. Quick “Aid Readiness” Checklist

- Completed FAFSA & CSS on Oct 1 launch day (earlier = bigger state aid pool)

- Pulled prior-prior tax returns + W-2s in PDF form

- Listed at least one financial safety school with automatic merit awards

- Scheduled appeal window (April) to compare and negotiate packages

Bottom line:

Ivies reward need, not numbers. Know the formulas, prep finances early, and you can let your student chase the dream school—without blind-siding the family budget.

%202.png)

.png)